Introduction

Personal financial management has not been left behind in an age where technology has permeated every aspect of our existence. Personal finance applications have emerged as indispensable resources that empower individuals to manage their financial well-being. From budgeting and expense monitoring to investment management and financial education, these applications provide a variety of features that simplify and improve our money management. This article examines the world of personal finance apps, delving into their benefits, types, key features, challenges, and best practices for maximizing these digital financial companions.

I. The Growth of Financial Apps

A. Technological Innovations in Private Finance

The transition from paper to digital platforms

Availability via devices and tablets

Altering how individuals interact with their finances.

B. Changing Financial Perspective

Raising awareness of the significance of financial literacy

Personal finance applications functions in education and empowerment

Promoting proactive financial decision-making and planning

Types of Personal Finance Applications

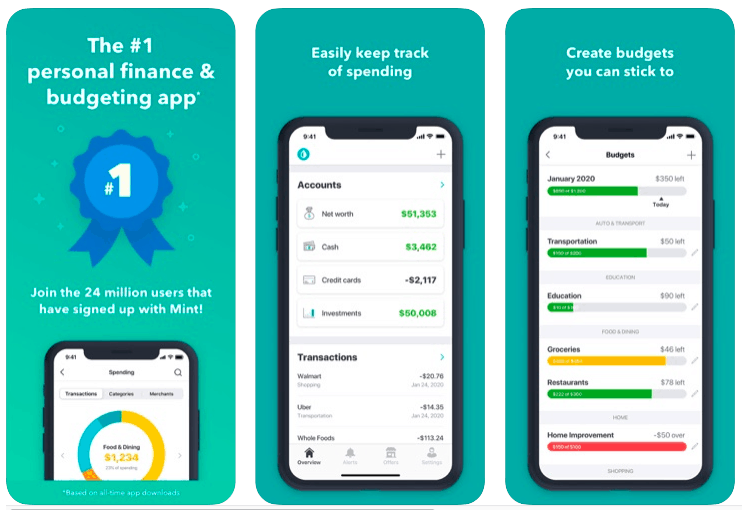

Apps for Budgeting and Expense Tracking

Developing financial objectives and budgets

Real-time tracking of income and expenditures.

Offering insight into expenditure trends and patterns.

B. Portfolio and Investment Management Applications

Facilitating stock trading and monitoring investments

Providing diversification and risk management instruments

Facilitating users’ investment decision-making

C. Applications of Financial Institutions and Banks

Facilitating account management and transactions with ease

Among the mobile banking features are money transfers and utility payments.

Multiple financial accounts are integrated for a holistic perspective.

D. Apps for Debt Management and Credit Score

Strategies for debt repayment and credit score improvement.

Monitoring credit reports and spotting potential mistakes

User education regarding the effect of credit on financial health

Important Features and Advantages

A. Setting Financial Objectives

Determining both short- and long-term objectives.

Progress monitoring and celebrating major achievements

Developing a sense of accomplishment and drive.

B. Automated Tracking of Expenses

Syncing with bank and credit card accounts for real-time updates

Categorizing expenses for improved analysis and visibility

Identifying potential areas for cost reduction and savings

Investment Perspectives and Analysis

Monitoring the performance of investments and market trends

Adapting portfolios to risk tolerance and objectives

Access to data and analysis tools in real-time

Financial Knowledge and Resources

Providing financial-related articles, videos, and tutorials

Developing the financial literacy and decision-making abilities of users

Enabling individuals to make educated decisions.

IV. Difficulties and Concerns

A. Data Privacy and Security

Protecting confidential financial information.

Encryption and authentication measures are implemented.

Compliance with data protection regulations is ensured.

B. Excessive Reliance on Technology

Combining automation and active financial participation

Developing an active approach to personal finance

Preventing disengagement from financial decision-making.

C. Application Choice and Compatibility

navigating the abundance of applications for personal finance.

App selection is based on individual requirements and objectives.

Ensuring device and operating system compatibility.

Guidelines for Optimizing Personal Finance Applications

A. Goal Specificity and Planning

Clearly defining financial objectives and priorities

Developing a strategic plan to accomplish these objectives

Utilizing app features to maintain focus and accountability

Consistent Monitoring and Assessment

Review your expenditures, investments, and financial progress on a regular basis.

Adapting one’s strategies to altering conditions

Celebrating triumphs and learning from failures.

Diversification and Risk Administration

Investigating various investment options and strategies.

Avoiding excessive dependence on a single asset or investment

Utilizing application-based simulation and analysis tools

Continued Learning and Development

Utilizing the app’s educational resources

Seeking external opportunities for financial education

Maintaining awareness of new app features and enhancements.

Conclusion

Personal finance applications have become indispensable companions on the path to financial independence and well-being. These digital tools offer a variety of advantages, from budgeting and expense monitoring simplification to investment analysis and financial literacy education. Individuals can take control of their financial futures, make informed decisions, and reach their financial objectives by utilizing the features and functionalities of personal finance apps. Personal finance applications are likely to play an even greater role in reshaping how we manage, comprehend, and optimize our finances as technology continues to advance.